Cash position expected to be at over $120 Million in just under 7 months as a public company

Financing provides cash runway to expedite cutting-edge portable nuclear microreactor technologies, auxiliary businesses, seek complimentary acquisitions and drive growth towards initial revenue generation

NANO Nuclear Energy Inc. (NASDAQ: NNE) (“NANO Nuclear” or “the Company”), a leading advanced nuclear energy and technology company focused on developing portable, clean energy solutions, today announced the execution of a definitive securities purchase agreement with three accredited institutional investors for a private placement which is expected to result in gross proceeds of approximately $60 million to NANO Nuclear, before deducting offering expenses.

The proceeds from this financing significantly augments NANO Nuclear’s cash on hand to over $120 million. With this cash on hand, NANO Nuclear will be able to more readily advance its cutting-edge microreactors, auxiliary businesses, seek complimentary acquisitions and drive growth towards initial revenue generation.

The definitive securities purchase agreement was executed on November 24, 2024, and the private placement is expected to close on November 27, 2024, subject to customary closing conditions. The Benchmark Company, LLC is acting as sole placement agent for the transaction.

Terms of the Private Placement

In connection with the private placement, the Company will issue an aggregate of 2,500,000 shares of common stock and five-year warrants to purchase an aggregate of up to an additional 2,500,000 shares of common stock, or 100% warrant coverage. Investors will pay a purchase price of $24.00 for each share and associated warrant. The warrants are exercisable for $26.00 per share.

The securities being sold in the private placement have not been registered under the Securities Act of 1933, as amended, or state securities laws and may not be offered or sold in the United States absent registration with the SEC or an applicable exemption from such registration requirements. The Company has agreed to file, by January 15, 2025, a registration statement with the SEC covering the resale of the shares of common stock and shares of common stock underlying the warrants issued in the private placement.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction.

Related Articles

NANO Nuclear Appoints Experienced Communications and Capital Markets Professional Matthew Barry as Director of Investor Relations

NANO Nuclear Energy Inc. (NASDAQ: NNE) (“NANO Nuclear” or “the Company”), a leading advanced nuclear energy and technology company focused on developing clean energy solutions, today announced that Matthew Barry has joined the Company as its Director of Investor...

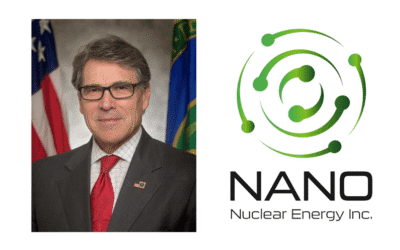

NANO Nuclear Appoints Former U.S. Secretary of Energy and 47th Governor of Texas Rick Perry as Chairman of its Executive Advisory Board

NANO Nuclear Energy Inc. (NASDAQ: NNE) (“NANO Nuclear” or “the Company”), a leading advanced nuclear energy and technology company focused on developing clean energy solutions, today announced that it has appointed Rick Perry, former Governor of Texas and the United...