NANO Nuclear Energy Inc. (NASDAQ: NNE) (“NANO Nuclear”), a leading vertically integrated advanced nuclear technology company developing proprietary, portable, and clean energy solutions, today announced the October 29, 2024 closing of the sale of an additional 317,646 shares of its common stock at $17.00 per share pursuant to the full exercise of underwriter’s over-allotment option granted in connection with NANO Nuclear’s recent underwritten follow-on public offering which closed on October 25, 2024.

The gross proceeds from this public offering, inclusive of the full over-allotment exercise, before deducting underwriting discounts and other offering expenses, were approximately $41.4 million, and net proceeds were approximately $37.7 million.

“The investor demand for this follow-on offering was significant, and we are grateful for the full exercise of the underwriter’s over-allotment option,” said Jay Yu, Founder and Chairman of NANO Nuclear Energy. “With the support of our investors, we are building a dynamic, commercially focused nuclear energy company led by world-class nuclear engineers and scientists as well as esteemed national leaders in military and civilian energy policy, former nuclear regulatory licensing and government energy professionals, all with the goal of developing the best in class, smaller, cheaper and safer advanced portable nuclear microreactors and other nuclear energy technologies and services. We look forward to using these offering proceeds to innovate, grow and drive value for our shareholders and the nuclear energy sector.”

The Benchmark Company, LLC acted as the sole book-running representative for the offering. Ellenoff Grossman & Schole LLP acted as counsel to NANO Nuclear. Lucosky Brookman LLP acted as counsel to The Benchmark Company. Withum Smith+Brown PC are NANO Nuclear’s registered independent auditors.

Registration statements relating to this public offering were filed with the Securities and Exchange Commission and declared. This registration statement can be obtained by visiting the SEC website at www.sec.gov. Please see such registration statement for additional information regarding NANO Nuclear.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Related Articles

NANO Nuclear Appoints Experienced Communications and Capital Markets Professional Matthew Barry as Director of Investor Relations

NANO Nuclear Energy Inc. (NASDAQ: NNE) (“NANO Nuclear” or “the Company”), a leading advanced nuclear energy and technology company focused on developing clean energy solutions, today announced that Matthew Barry has joined the Company as its Director of Investor...

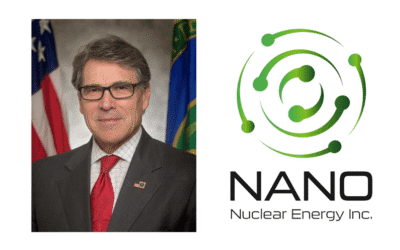

NANO Nuclear Appoints Former U.S. Secretary of Energy and 47th Governor of Texas Rick Perry as Chairman of its Executive Advisory Board

NANO Nuclear Energy Inc. (NASDAQ: NNE) (“NANO Nuclear” or “the Company”), a leading advanced nuclear energy and technology company focused on developing clean energy solutions, today announced that it has appointed Rick Perry, former Governor of Texas and the United...